The euro rose as high as $1.2389 against the dollar yesterday after the European Central Bank kept interest rates flat at 2.0%, in line with expectations. In addition, ECB President Jean-Claude Trichet said that there was no reason to hurry...

...to ease policy. Earlier, the euro's bullish run was triggered by favourable manufacturing data out of Europe, with the Reuters Eurozone Purchasing Managers Index speeding up to 53.3 in March from 52.5 in February. The market had predicted a small decline to 52.3. The dollar later regained some ground after comparable manufacturing report from the U.S. also showed a stronger-than-expected reading. The Institute for Supply Management's index grew to 62.5 last month from February's 61.4, beating forecasts for a drop to 60.0. Today's main focus is on U.S. jobs report for March. Economists predict the non-farm sector of the economy created 103,000 jobs, compared to 21,000 in February. The unemployment rate is expected to be unchanged from February, at 5.6%.

The Czech crown recovered from a session low of 32.94 to the euro and closed the Thursday's trading moderately stronger versus the single currency. No fundamental reason seems to have been behind the move.

|

FX RATES |

| USD/CZK |

26.560/590 |

| USD/GBP |

1.8494/99 |

| EUR/CHF |

1.5618/28 |

| EUR/CZK |

32.740/765 |

| USD/YEN |

104.25/29 |

| EUR/GBP |

0.6663/66 |

| EUR/USD |

1.2324/28 |

| EUR/YEN |

128.47/60 |

|

STOCK MARKETS |

| NIKKEI |

11815.95 |

+132.53 |

| HANG SENG |

12739.69 |

+63.44 |

| FTSE 100 |

4410.7 |

+25.0 |

| DAX 30 |

3924.85 |

+68.15 |

| DJ INDEX |

10373.33 |

+15.63 |

| NASDAQ |

2015.01 |

+20.79 |

| PX 50 |

830.2 |

+6.4 |

| GOLD |

426.05/+426.80 |

- |

| DEPOSIT RATES |

| |

CZK |

USD |

EUR |

YEN |

| ON |

1.90-2.00 |

1.00-1.05 |

2.01-2.04 |

--- |

| 3M |

1.95-2.05 |

1.03-1.08 |

1.99-2.02 |

-0.06-0.01 |

| 6M |

2.01-2.11 |

1.10-1.15 |

1.98-2.01 |

-0.05-0.02 |

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

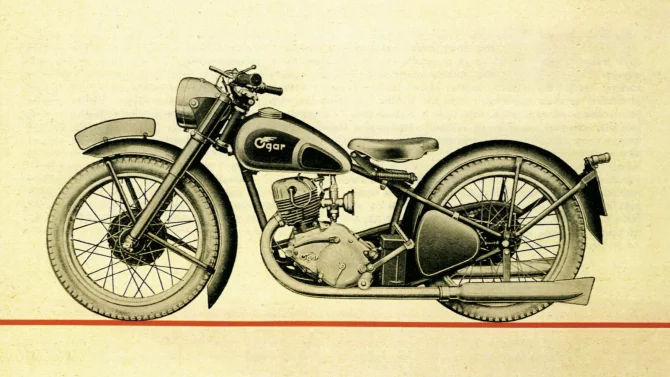

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce