The dollar firmed moderately against the euro on Monday, but the activity was low, with London markets closed for the May Day bank holiday. However, a weaker-than-expected U.S. manufacturing report hit the dollar briefly. The Institute for...

...Supply Management showed its manufacturing index dropped to 62.4 in April from 62.5 in March, while economists had forecast an increase to 63.0. Later, the dollar regained ground, with market participants turning their attention to Federal Reserve's interest rate decision due late Tuesday. The market expects no change in rates. In the eurozone, Reuters index of manufacturing activity rose to 54.0 in April, the highest level in over three years, from 53.3 in March, but the euro was little changed.

The Czech currency traded in a very narrow band yesterday, ending the session flat against the euro. Traditionally, the crown ignored a report on central state budget performance. The cumulative January-April deficit widened sharply to 38.1 billion crowns from 7.8 billion for Q1, mainly on the back of state contribution to construction savings.

|

FX RATES |

| USD/CZK |

27.210/240 |

| USD/GBP |

1.7742/52 |

| EUR/CHF |

1.5530/43 |

| EUR/CZK |

32.510/535 |

| USD/YEN |

110.44/49 |

| EUR/GBP |

0.6728/31 |

| EUR/USD |

1.1944/46 |

| EUR/YEN |

131.90/95 |

|

STOCK MARKETS |

| NIKKEI |

11761.79 |

–242.50 |

| EUROSTOXX 50 |

2806.46 |

+18.98 |

| FTSE 100 |

4489.7 |

--- |

| DAX 30 |

4007.65 |

+22.44 |

| DJ INDEX |

10314.00 |

+88.43 |

| NASDAQ |

1938.72 |

+18.57 |

| PX 50 |

816.7 |

–1.3 |

| GOLD |

387.60/+388.30 |

- |

| DEPOSIT RATES |

| |

CZK |

USD |

EUR |

YEN |

| ON |

1.90-2.00 |

1.00-1.05 |

2.02-2.05 |

--- |

| 3M |

2.02-2.12 |

1.09-1.14 |

2.04-2.07 |

-0.07---- |

| 6M |

2.15-2.25 |

1.32-1.37 |

2.07-2.10 |

-0.04-0.03 |

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

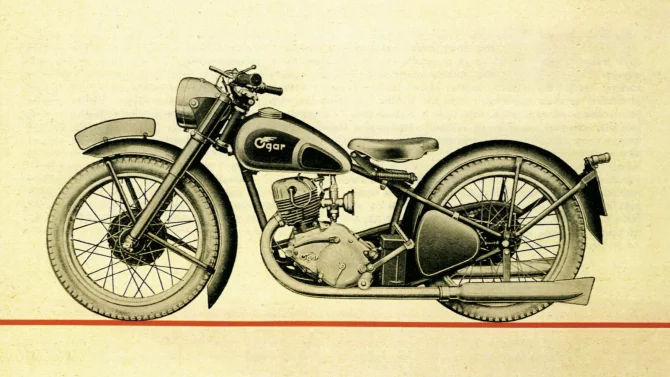

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce