The U.S. currency rose against the euro in a technically-driven trade yesterday. The move seemed to be a correction of dollar's losses from the previous day. In the European session, the dollar also received some support against the single...

...currency from German ZEW economic sentiment indicator, which surprisingly dropped to 46.4 in May, the lowest level since July, from 49.7 in April. Hawkish remarks on inflation from Federal Reserve representatives encouraged speculations over dollar-supportive interest rate hike. Against the yen, however, the dollar dipped after news that Japan's economy posted a robust 1.4% growth in the first quarter versus the previous three months. The market had anticipated a 0.9% expansion.

Recovering from an early drop as low as 31.94 to the euro, the Czech crown closed Tuesday's session almost flat at around 31.80 versus its main reference currency. Mainly technical factors are expected to drive the market in the rest of this week as no major economic data releases are on the calendar.

|

FX RATES |

| USD/CZK |

26.430/460 |

| USD/GBP |

1.7762/65 |

| EUR/CHF |

1.5356/65 |

| EUR/CZK |

31.810/845 |

| USD/YEN |

112.70/73 |

| EUR/GBP |

0.6772/76 |

| EUR/USD |

1.2024/29 |

| EUR/YEN |

135.55/67 |

|

STOCK MARKETS |

| NIKKEI |

10967.74 |

+256.65 |

| EUROSTOXX 50 |

2675.75 |

+15.90 |

| FTSE 100 |

4418.0 |

+3.6 |

| DAX 30 |

3789.24 |

+34.87 |

| DJ INDEX |

9968.51 |

+61.60 |

| NASDAQ |

1897.82 |

+21.18 |

| PX 50 |

744.9 |

+5.9 |

| GOLD |

380.00/+380.75 |

- |

| DEPOSIT RATES |

| |

CZK |

USD |

EUR |

YEN |

| ON |

1.90-2.00 |

0.99-1.04 |

2.01-2.04 |

--- |

| 3M |

2.05-2.15 |

1.20-1.25 |

2.06-2.09 |

-0.07---- |

| 6M |

2.20-2.30 |

1.48-1.53 |

2.11-2.14 |

-0.04-0.03 |

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

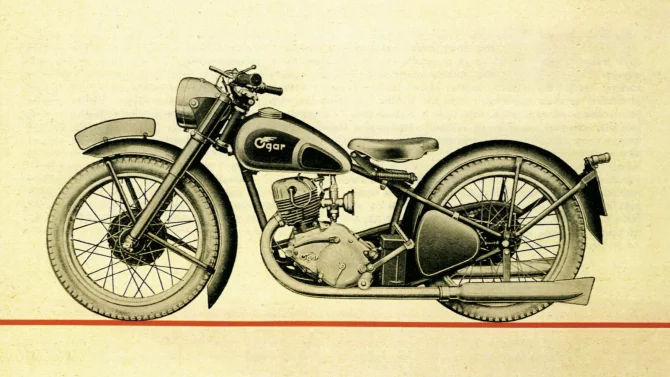

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce