The U.S. dollar rebounded from two-week lows against the euro and the yen late Friday due mainly to profit-taking. Earlier, the dollar came under selling pressure after Fed Governor Ben Bernanke's statement showed that U.S. central bank's...

...interest rate hikes should be modest. This disappointed some traders, who had anticipated the Federal Reserve to raise rates agressively. As there was no important economic data in the U.S. on Friday, market players turned their attention to a weekend meeting of G7 finance ministers in New York and an informal gathering of OPEC ministers in Amsterdam. Most recently, Saudi Arabia reported it was increasing its oil output to boost global oil supply.

Foreign banks' euro-sell orders sent the crown to a new six-month peak of 31.750 versus the single currency on Friday. Prospects for higher Czech interest rate also provided impetus to the crown's rally.

|

FX RATES |

| USD/CZK |

26.600/630 |

| USD/GBP |

1.7841/45 |

| EUR/CHF |

1.5361/71 |

| EUR/CZK |

31.760/790 |

| USD/YEN |

112.58/63 |

| EUR/GBP |

0.6692/95 |

| EUR/USD |

1.1943/48 |

| EUR/YEN |

134.47/56 |

|

STOCK MARKETS |

| NIKKEI |

11101.64 |

+31.39 |

| EUROSTOXX 50 |

2697.46 |

–11.09 |

| FTSE 100 |

4431.4 |

+2.7 |

| DAX 30 |

3831.84 |

–7.48 |

| DJ INDEX |

9966.74 |

+29.10 |

| NASDAQ |

1912.09 |

+15.50 |

| PX 50 |

759.0 |

–1.7 |

| GOLD |

383.85/+384.35 |

- |

| DEPOSIT RATES |

| |

CZK |

USD |

EUR |

YEN |

| ON |

1.90-2.00 |

0.99-1.02 |

2.00-2.03 |

--- |

| 3M |

2.07-2.17 |

1.22-1.25 |

2.06-2.09 |

-0.07--0.02 |

| 6M |

2.21-2.31 |

1.54-1.57 |

2.12-2.15 |

-0.05---- |

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

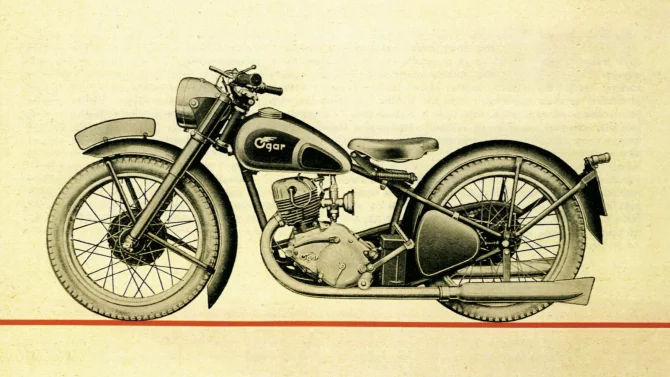

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce