The U.S. dollar remained under a selling pressure yesterday, with the markets wondering whether high oil prices would dampen U.S. economic recovery and discourage the Federal Reserve from raising interest rates. Neither economic data...

...releases out of the U.S. helped the dollar. Durable goods orders declined by more-than-expected 2.9% in April, after an upwardly revised 5.7% jump in the previous month. Economists on average had predicted a 0.2% drop. U.S. new home sales slid 11.8% in April, compared with a record-high growth rate in March.

The Czech currency fell from its 8-month highs versus the euro on Wednesday after higher-than-expected foreign trade deficit weighed on the positive sentiment on the market. The April trade gap amounted to 10.8 billin crowns, while analysts had forecast a 5.0 billion shortfall. The Czech National Bank holds a monetary policy meeting today, but the market expects no hike in interest rates.

|

FX RATES |

| USD/CZK |

26.075/105 |

| USD/GBP |

1.8234/38 |

| EUR/CHF |

1.5370/80 |

| EUR/CZK |

31.755/780 |

| USD/YEN |

111.33/38 |

| EUR/GBP |

0.6665/68 |

| EUR/USD |

1.2156/61 |

| EUR/YEN |

135.35/44 |

|

STOCK MARKETS |

| NIKKEI |

11166.03 |

+13.94 |

| EUROSTOXX 50 |

2729.62 |

+30.26 |

| FTSE 100 |

4438.3 |

+20.3 |

| DAX 30 |

3867.52 |

+39.45 |

| DJ INDEX |

10109.89 |

–7.73 |

| NASDAQ |

1976.15 |

+11.50 |

| PX 50 |

770.2 |

+10.5 |

| GOLD |

391.70/+392.40 |

- |

| DEPOSIT RATES |

| |

CZK |

USD |

EUR |

YEN |

| ON |

1.90-2.00 |

1.00-1.03 |

2.01-2.04 |

--- |

| 3M |

2.10-2.20 |

1.26-1.29 |

2.05-2.08 |

-0.06--0.01 |

| 6M |

2.23-2.33 |

1.53-1.56 |

2.11-2.14 |

-0.04-0.01 |

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

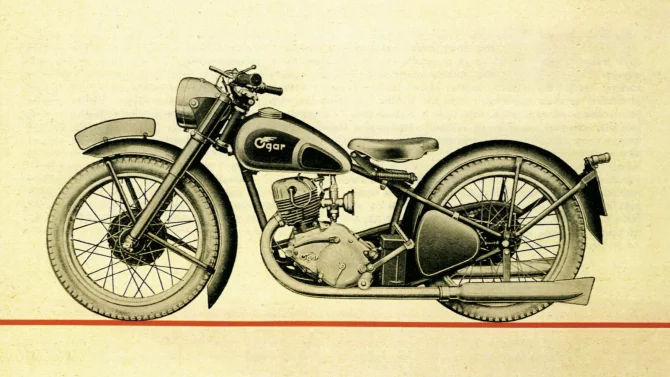

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce