...the possibility of a sooner-than-expected easing of

monetary policy.

The Statistics Office released data on Tuesday showing the

annual rate of consumer price inflation eased to 2.7 percent in

February, in line with market expectations, from a 3.0 percent

rise in the previous month.

Analysts said the overall structure of price growth was

developing favourably, adding there was a slowdown in the growth

dynamics of food and housing prices in February compared with

the previous month.

"These figures (February CPI) are favourable for meeting the

Maastricht criterion," said Tatra Banka analyst Juraj Valachy of

the data calculated under local methodology.

"We expect the central bank could cut interest rates by 25

basis points already in the second quarter and these inflation

figures support this view."

The central bank, which targets inflation calculated by the

EU methodology as part of country's plan to adopt the euro in

2009, sees the end-2007 inflation rate at 1.5 percent.

Most analysts expect the central bank (NBS) to start

monetary easing in the second half of the year, but a strong

crown could accelerate the process.

"The timing of the first rate reduction depends mainly on

the crown's development," said Miroslav Plojhar, chief analyst

at Citibank Prague.

He said he expects the central bank to cut rates in

mid-year, though if there is a "continued appreciation of the

crown significantly below 34.0 per euro, a first rate cut by

25-50 basis points will come sooner".

The crown hit a record of 33.80 per euro last week, driven

by expected foreign direct investment inflows and record 8.3

percent GDP growth in 2006.

The jump in the crown triggered direct intervention by the

central bank on Thursday to cap the currency's rise.

The crown weakened after the data to 34.150 per euro from

34.085 before the release, and was trading at 34.120 per euro

as of 0920 GMT.

Slovak Feb CPI benign, may bring forward rate cut

13.03.2007 | (ext), Reuters

Zpravodajství ČTK

Zdroj: Finance.cz

Zdroj: Finance.cz

By Martin Santa BRATISLAVA, March 13 (Reuters) - Slovak consumer price growth remained benign in February, and analysts said this raised...

Články ze sekce: Zpravodajství ČTK

AUTA

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

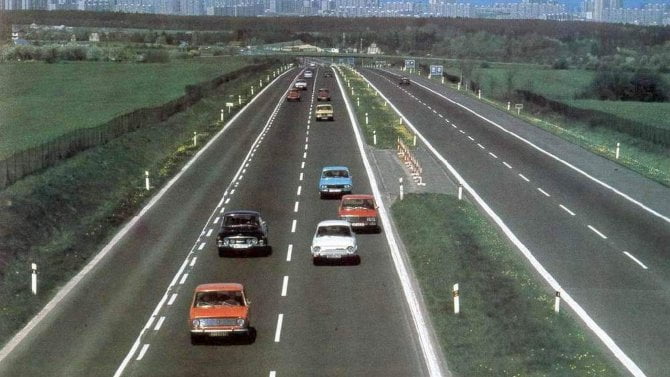

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze