...

PRAGUE, March 22 (Reuters) - The Czech Republic plans to re-launch buy-backs of outstanding state debt later this year, seeking to mirror the approach of other European Union countries in supporting market liquidity, officials said on Thursday.

The Finance Ministry would like to revive a practice of inviting bond holders to offload government paper before maturity, mostly through special reverse auctions, which it scrapped three years ago due to poor investor interest. The ministry said it aimed to launch a revamped buy-back scheme in the second half of this year, copying the rules from established markets of members of the Organisation for Economic Cooperation and Development (OECD).

"We need to be well prepared and will be talking to primary debt dealers before the launch," Jiri Franta, head of the ministry's debt management unit, told Reuters.

The lower house of parliament gave a final approval this week to a bill allowing the ministry to issue 10 billion crowns ($478.5 million) worth of new bonds to finance the buy-backs of outstanding issues with maturity of more than 1 year.

Buying back the outstanding bonds before the due date would reduce the pressure on the government's finances stemming from the need to redeem a large bond in a single day. Issues worth 40 billion crowns and more are set to mature from 2008 onwards.

"The introduction of buy-backs, switches and repo operations with medium- and long-term state bonds on the market before their maturity will allow for a more flexible state debt management," said the commentary on the new legislation.

The bill has yet to be passed by the upper house, the Senate, and must be signed by the president before becoming law. The Czech Republic has been the only one of the three largest central European economies not to buy back maturing state debt since its reverse bond auctions flopped in 2004.

Neighbouring Poland holds switch tenders to roll forward government debt by selling new longer-dated notes in return for bonds about to mature. Hungary also performs reverse auctions.

However, some debt traders said it remained to be seen how successful the Czechs are with the revived buy-backs.

"I understand they want to use the same debt-management practices as west European peers but there is little point in launching these buy-backs unless they target the least liquid, small quasi-government issues," said one Prague-based trader. ($1=20.90 Czech Crown)

Keywords: CZECH DEBT/

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

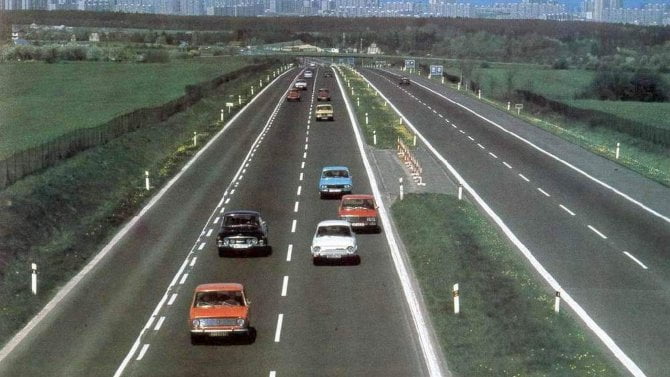

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme