...

By Marek Petrus

Some Czech central bankers worry strong economic growth and declining unemployment might spur inflation, the minutes of their April 26 meeting showed on Friday, cementing market expectations of a near-term interest rate rise.

As already announced after the monthly policy meeting last week, four out of six policymakers present voted to hold the main policy rate at 2.50 percent for a seventh straight month while two dissenters voted for a 25 basis point increase.

Members of the policy board agreed the economy would sustain a robust pace of growth but voiced differing views over whether the inflation outlook required imminent tightening of policy.

Still, markets took the central bank's hawkish signals about the risk of resurgent price growth as a confirmation of widespread bets that a quarter point rate hike could come as early as the next meeting on May 31.

"I believe interest rates will go up in the second quarter and the only question remaining is whether it will be already in May or in June," said Radomir Jac, chief analyst at PPF Asset Management in Prague.

"The board has ample reason to be forward-looking and take a pro-active approach and lead the market ... but the minutes confirm the dovish wing does not want to raise rates, or at the very least believes the later rates rise the better," he added.

The crown inched 0.2 percent higher to 28.100 per euro while money market rates and debt yields were flat.

"ONSET OF WAGE PRESSURES"

Minutes showed some bankers thought inflation factors were building up but others argued it was too early to talk about such a build-up and more time was needed to examine the economy and its trends before changing policy.

But they also re-iterated a warning that faster economic growth in Europe, strong domestic expansion and the falling joblessness -- its rate matched a record low of 7.3 percent in March and may drop further -- could all fan pressures on prices.

"It was said several times that unemployment was coming down fairly rapidly and that this might signal the onset of wage inflation pressures," said minutes. Some analysts believe nominal wage growth quickened to 8-10 percent in January-March.

"However, it was also said several times that strong competition, inflow of labour from abroad, capitalisation of labour and growing mobility on the labour market were putting the brakes on these pressures," minutes added.

The central bank has paused since tightening policy by a cumulative 75 basis points between October 2005 and September 2006 to prevent record economic expansion of about 6 percent annually from fuelling price pressures.

"The drop in unemployment and the risk of pass-through of labour market pressures to wages and inflation is the focal point of a decision on interest rates," said David Marek, chief analyst at Patria Finance who sees a rate hike in May or June.

Keywords: CZECH ECONOMY/CENTRALBANK

[PRAGUE/Reuters/Finance.cz]

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

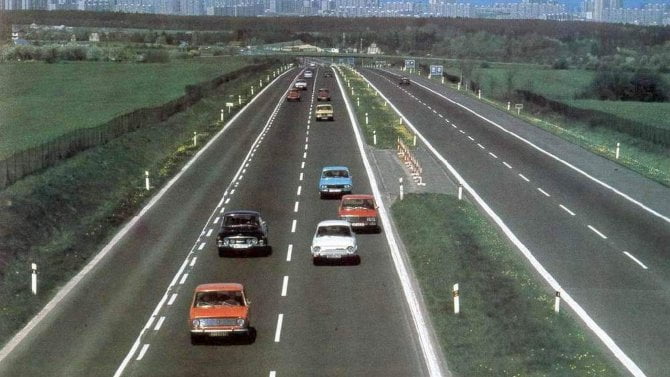

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety