...

Czech generic drugs maker Zentiva posted a 1.6 percent rise in net profit to 518.9 million crowns ($24.86 million), missing expectations as lower than expected sales growth hurt, pushing its shares down.

The market had expected an 11 percent rise in net profit after a weak first quarter in 2006 when tougher drug prescriptions rules ate into the bottom line.

Total first-quarter net sales rose 6.3 percent to 3.38 billion crowns, lagging 3.62 billion crowns forecast by nine analysts in a Reuters poll.

Earnings before interest and tax (EBIT) was flat at 760.1 million, lagging forecast of 838 million.

Zentiva shares fell 2.5 percent to 1,435 crowns at 1111 GMT, underperforming the PX index which was up 0.4 percent.

"I call it lacklustre," said Erste Bank analyst Vladimira Urbankova.

"In the long-run there is perspective, but I think in the next few days the stock will lose as the market crunches the numbers. The biggest fallout was on the domestic market, where expectations were for some growth after the weak first quarter last year," she said.

Domestic sales edged up 0.3 percent to 1.11 billion crowns.

Last year's first quarter was marred by tougher government prescription policy, and Zentiva also booked one-off costs, worth 76 million crowns on the operating profit level, due to the integration of Romanian generic drug maker Sicomed .

The stock has jumped by one fifth since 2006 results released at the beginning of March, when the firm announced the acquisition of 75 percent in Turkish drug maker Eczacibasi.

France's Sanofi-Aventis is Zentiva's largest shareholder with a 24.9 percent stake.

[PRAGUE/Reuters/Finance.cz]

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

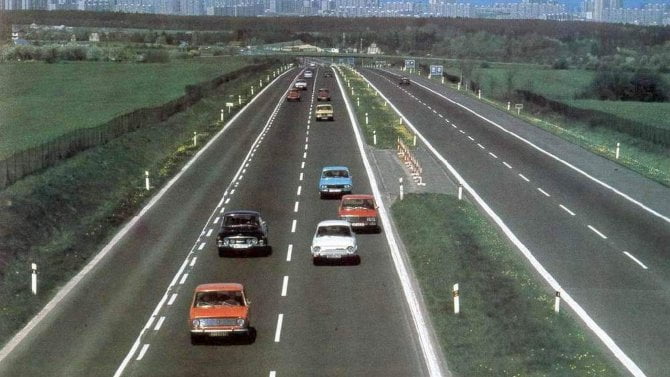

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety