...

By Marek Petrus

The Czech central bank expects the crown to stay around 28.20 per euro until the end of this year, its chief forecaster said on Thursday, showing the CNB was less bullish on the currency than the market.

Tomas Holub, head of the CNB's monetary department who is not a policymaker, wrote in an article in the weekly Ekonom that the bank's new inflation forecast did not expect the crown to resume its gradual firming trend until sometime next year.

The crown traded around 28.0 per euro at 0710 GMT, nearly 2 percent weaker over the year-to-date. It has been a popular source of cheap funds for investors locking in higher yields elsewhere as Czech rates are the lowest in the European Union.

CNB policymakers used the projection of a steep increase in inflation to more than 4 percent next year to back up last week's 25 basis point interest rate hike to 3 percent. [ID:nL26800751]

Holub said the staff forecast was counting on a stable crown due to expected further rate hikes by the European Central Bank, whose main policy rate is already a full 1 percentage point above the Czech equivalent.

"A gradual firming in the crown will only resume during 2008," wrote Holub.

Market expectations are in favour of a stronger currency in six and 12 months from now.

The median forecast of 13 market watchers surveyed by Reuters on July 11 and 13 was for the crown to edge up to 27.80 to the euro within six months, and rise to a record high of 27.30 in a year from now [CZK/POLL].

A renewed firming in the crown might improve the inflation outlook, cutting import prices and eating into firms' export revenue.

Some analysts have said the crown's rise over the past four weeks to Friday's 3-1/2-month highs at 27.91 to the euro could tame policymakers' resolve to rush with further rate hikes.

The CNB will release the July Inflation Report detailing its updated quarterly projections on Friday.

[PRAGUE/Reuters/Finance.cz]

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

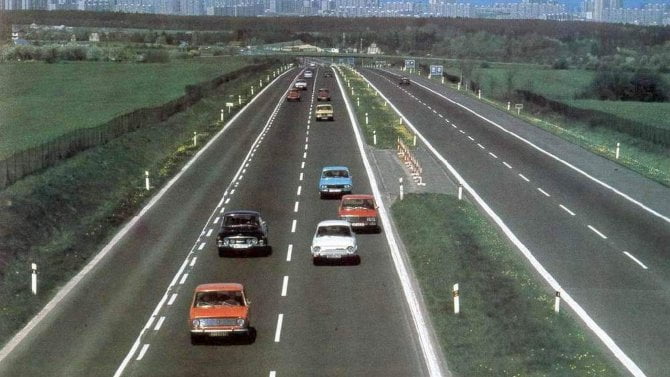

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme