...favourable budget trends.

Total demand in the auction was 2.253 billion crowns ($93.37

million) in the twelfth sale of the bond maturing in 2012, below

3.247 billion in the previous auction in May, according to the

finance ministry's Debt and Liquidity Management Agency.

The debt agency did not comment on the auction, but traders

said the outcome was no surprise.

"Average interest rates are still higher than in the spring.

The ministry has no shortage of funds, and they also do not want

to borrow at higher rates," said Tatra Banka dealer Elizej

Macho.

The average yield demanded by investors was 4.642 percent on

Monday, compared with 4.369 percent the agency accepted on May

28. The paper was quoted at 4.657/4.507 at the secondary market

on Monday.

The minimum demanded yield was 4.412 percent, while the

maximum bid stood at 4.690 percent.

The debt agency said in June it had almost satisfied its

borrowing needs for this year and would probably not issue many

more domestic bonds in the coming months.

It also said it had taken advantage of favourable market

conditions in the first months of the year to sell more domestic

paper than it originally planned.

The state sold 1.157 billion crowns worth of the 2012-bond

in the last successful auction in May, and a total of 21.6

billion worth of the 5-year paper this year.

The central state budget showed a surplus of 3.86 billion

crowns for January-July, confirming positive trends in public

finances.

[BRATISLAVA/Reuters/Finance.cz]

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

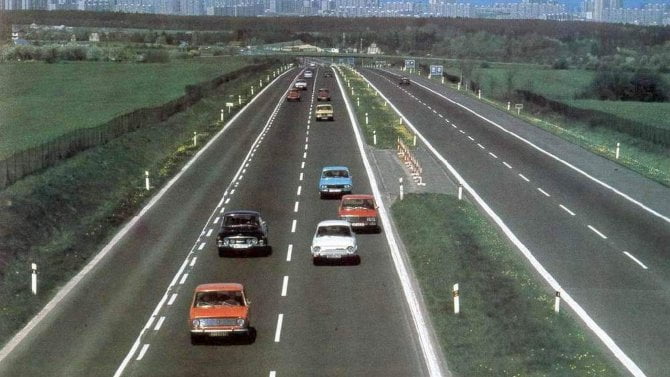

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety