...Jan Korselt

Net profit at Czech power firm

CEZ is expected to rise by 21.6 percent in the

second quarter on higher electricity prices and acquisitions,

which compensated for slowing growth in domestic demand, a

Reuters poll showed on Monday.

The average forecast in a Reuters survey of nine analysts saw

net profit of 7.1 billion crowns ($346 million) for the second

quarter, compared with 5.8 billion in the same period last year.

Sales were seen at 39.7 billion crowns, up 11.3

percent year-on-year.

"The higher sales on year-on-year basis are mainly due to

the 16 percent increase of 2007 electricity prices and the

inclusion of Polish power plants... and Bulgarian power plant

Varna," said Jakub Zidon, an analyst at Ceska Sporitelna.

CEZ started to consolidate two Polish power plants in June

2006, while the acquisition of Varna was finalised last October.

The average forecast for earnings before interest, tax,

depreciation and amortisation (EBITDA) was 16.0 billion crowns,

up 16 percent year-on-year.

In July, CEZ warned it faced a challenge to meet its

full-year projection of 70.9 billion crown EBITDA, due to a mild

winter that curbed demand for heating.

Therefore, analysts will closely watch any further comments

on the company's outlook.

"Though the markets are nowadays more interested in the

share buyback than the quarterly results, those could clearly

suggest if we will have to revise the expected results for the

full 2007," said Marek Hatlapatka, an analyst at the

Cyrrus brokerage.

CEZ shares have risen by 10.5 percent so far this year,

underpinned by a share buy-back which has so far drained almost

4 percent of outstanding stock from the market.

On Friday afternoon, the stock closed at 1,062 crowns, 2.4

percent lower on a broad market sell-off due to credit worries

in the United States, retreating further from its all-time high

from July. It opened 1 percent up on Monday.

The company, with a market capitalisation of $31.3 billion,

is 68 percent state owned, but the government plans to sell

a 7 percent stake this year to fund road building.

Consolidated figures in billions of crowns:

Q2/07 Average Median Range Q2 2006

Sales 39.66 39.80 38.20-41.51 35.64

Core profit (EBITDA) 15.97 15.90 15.59-16.40 13.77

Oper profit (EBIT) 10.48 10.40 10.00-11.18 8.39

Net profit 7.05 7.05 6.37- 7.60 5.80

H1/07 Average Median Range H1 2006

Sales 83.79 83.90 82.30-85.63 77.18

Core profit (EBITDA) 37.70 37.60 37.33-38.10 34.17

Oper profit (EBIT) 26.79 26.71 26.30-27.49 23.21

Net profit 19.69 19.73 19.05-20.00 15.79

NOTE - The following equity houses took part in the poll:

Atlantik FT, BH Securities, Cyrrus, Erste Bank/Ceska Sporitelna,

KBC/Patria Finance, Raiffeisenbank, Sal.Oppenheim, UniCredit

Global Research, Wood&Company.

[PRAGUE/Reuters/Finance.cz]

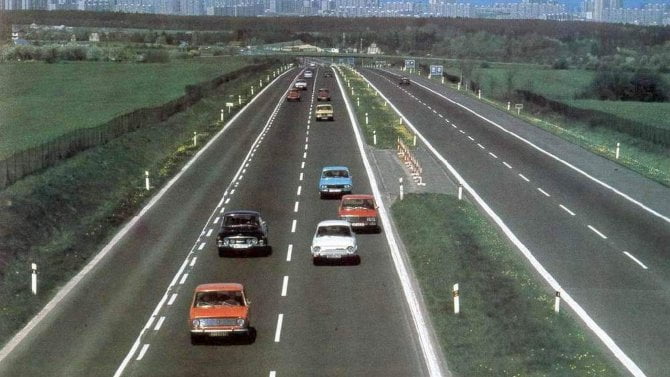

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme

S některými ojetinami je tolik problémů, že je evropská platforma odmítá prodávat. Na seznamu jsou i slavná jména

S některými ojetinami je tolik problémů, že je evropská platforma odmítá prodávat. Na seznamu jsou i slavná jména