...

* What: Czech Q2 GDP, inflation data

* When: GDP on Sept 7, CPI on Sept 10

* Czech growth seen remaining strong, inflation to edge up

By Mirka Krufova and Jan Lopatka

PRAGUE (Reuters) - The Czech economy remained on a strong expansionary path in the second quarter, propelled by household demand which has spurred inflation pressures, analysts estimated in a Reuters poll on Wednesday.

The poll of 13 analysts, taken Aug 24-28, showed a median expectation for 6.0 percent second quarter GDP growth, marginally off the 6.1 percent rate seen in the first three months this year, as well as in the final quarter of 2006.

"GDP growth will confirm overall pressures from the real economy as pro-inflationary," said Raiffeisenbank analyst Ales Michl. "Demand-side inflation pressures will confirm the legitimacy of further moderate growth in interest rates."

But some slowdown is expected in the rest of 2007, as shown by the median and mean average forecasts of 5.7 percent full-year growth.

The data is due out at 9 a.m. (0700 GMT) on September 7.

The Czech economy had been growing quickly with little inflation pressure thanks to rising exports by newly-built factories making goods for west European markets. But rising household spending has taken over as the main growth driver.

Atlantik FT analyst Petr Sklenar said foreign demand gave a negative contribution to year-on-year growth, because changing terms of trade negated the ever-higher trade surplus.

Inflation was seen edging up in August. Analysts forecast a 0.3 percent monthly rate, the poll showed, putting year-on-year inflation at 2.4 percent, up from 2.3 percent in July.

Inflation data are due at 9 a.m. (0700 GMT) on Sept. 10.

So far, inflation has been safely within the central bank's +/- 1 percentage point band around 3 percent, but it is expected to break higher due to demand-side pressure in a fast-growing economy already showing signs of labour shortages.

The central bank sees inflation accelerating to 3.5-4.9 percent in June next year, and has begun tightening monetary policy to counter the expected price rises.

Indirect tax increases planned under government fiscal reforms are expected to add to the rise in inflation, although the central bank excludes the primary impact of indirect tax changes when assessing policy.

The market is split on whether the bank will raise interest rates at its next meeting on Thursday, following a quarter percentage-point rise in July which brought the main two-week repo rate to 3.0 percent.

Foreign trade was expected to in balance in July, the poll showed.

For a TABLE with GDP forecasts, click on [ID:nL29212216] or TABLE with monthly indicators forecast, click [ID:nL29909001] or

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

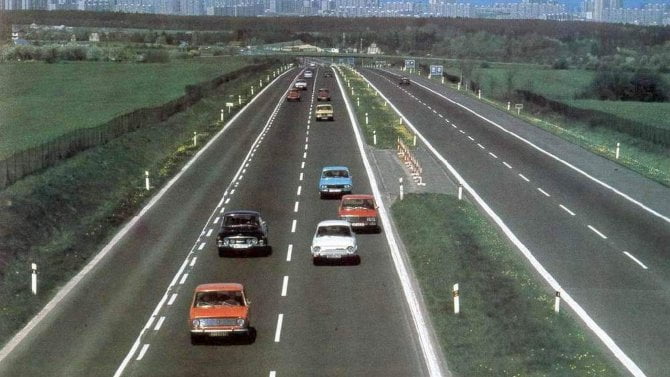

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme