...meeting, released on Friday.

Present at the meeting: Zdenek Tuma (Governor), Ludek Niedermayer (Vice-Governor), Miroslav Singer (Vice-Governor), Mojmir Hampl (Chief Executive Director), Robert Holman (Chief Executive Director), Pavel Rezabek (Chief Executive Director), Vladimir Tomsik (Chief Executive Director).

The meeting opened with a presentation of the August situation report, which focused on summarising the newly available information and on assessing the risks of the July macroeconomic forecast.

At 2.3 percent in July, annual consumer price inflation had been 0.2 percentage points lower than forecasted. This deviation had been due mainly to lower-than-expected adjusted inflation excluding fuels. The approval of the public finance reform was new information. This would affect inflation primarily by increasing the contribution of growth in indirect taxes. However, monetary policy does not react to the first-round impacts of these taxes. New information from the external environment included a lower outlook for foreign interest rates, linked with the recent turbulence on the U.S. mortgage market. On the labour market, nominal wage growth in the second quarter had been slightly lower than expected.

After the presentation of the situation report, the Board discussed the risks of the July forecast, which predicted a further rise in interest rates. The members agreed that the aforementioned turbulence in global financial markets was not yet significant for the Czech economy and the monetary policy settings. In this context, there was also discussion of the exchange rate, which had appreciated quite considerably over the past month. It was also said that this appreciation could not easily be explained by fundamentals. Mention was made of its link with the liquidation of carry trades in which the Czech koruna had been the financing currency. Some of the members viewed the appreciation of the koruna and the heightened uncertainty regarding its future evolution as a significant downside risk to inflation.

Against this, however, it was said that the movement of the exchange rate had brought the economy closer to the sensitivity scenario of the July forecast (i.e. the stronger exchange rate scenario) and that growth in interest rates was consistent with this scenario as well.

The Board then discussed the deviation of adjusted inflation excluding fuels from the forecast. Some of the members argued that this deviation did not confirm the inflationary effect of the interest rate component of the monetary conditions as considered in the forecast. This deviation was meanwhile the biggest in two years, despite only a month having passed since the July forecast. Against this, it was argued that this deviation was largely due to the materialisation of risks associated with changes to the consumer basket. The possibility of seasonality shifts linked with the change in the basket at least partially offsetting this deviation in the future could not be ruled out. Alternative price indices were not suggesting diminishing inflation pressures. In addition, faster-than-forecasted growth in food prices could be expected.

The Board spent quite some time discussing the impacts of the recently approved reform of public finances.

It was said that the aggregate impact of the reform on economic growth via a negative fiscal impulse would be relatively small. Some of the members argued, however, that there might be structural impacts linked with redistributions between the household and corporate sectors and between individual household income groups. These might lead to asymmetric impacts on household consumption and company investment, with a possible relative decrease in household demand. Mention was also made of the associated problem of the pass-through of the changes to indirect taxes. It was said that while the first-round impacts of the changes to indirect taxes on prices could be sizeable, the second-round effects would be relatively weak. Nonetheless, the first-round impacts of the tax changes would imply only a one-off increase in the price level, not an increase in long-run inflation, and were therefore irrelevant from the monetary policy perspective, since monetary policy reacts only to the second-round effects of tax changes.

Some of the members also highlighted the anti-inflationary deviation in nominal wage growth from the forecast. Against this, however, the prevailing view was that the new labour market data confirmed the forecast assumptions of an upswing in wage growth and nominal unit wage cost growth. Other labour market indicators, such as employment growth, were conversely fostering faster wage growth.

The growing labour demand and limited labour supply might signify the emergence of bottlenecks in the economy. These bottlenecks may already be apparent in the construction industry, for example.

At the close of the meeting the Board decided by a majority vote to increase the CNB two-week repo rate by 0.25 percentage point to 3.25 percent, effective 31 August 2007. At the same time it decided to increase the discount rate and Lombard rate by the same amount, to 2.25 percent and 4.25 percent respectively. Four members voted in favour of this decision, and three members voted for leaving rates unchanged. (Reporting by Mirka Krufova in Prague)

Keywords: CZECH ECONOMY/CBANK

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

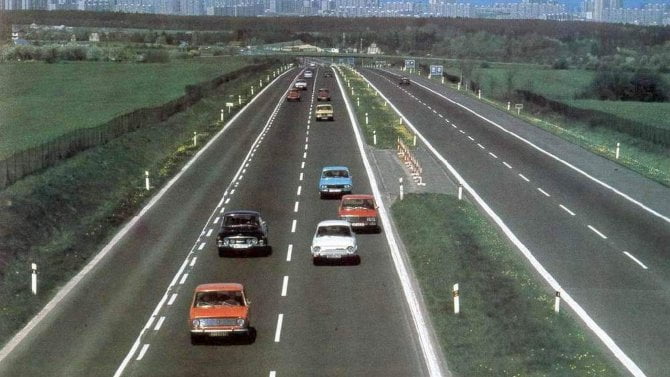

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme