...

PRAGUE, Sept 24 (Reuters) - The Czech Republic plans to raise funds abroad to finance state debt next year, documents accompanying the 2008 state budget draft showed.

The European Union member country, rated 'A-' by Standard and Poor's, issued two Eurobonds in 2004 and 2005, but have since shied away from foreign borrowing as domestic debt costs remained low and the budget performed better than expected.

The documents did not specifically say the Czechs would issue eurobonds, but said that the country's foreign debt would rise by more than 70 billion crowns ($3.59 billion) next year.

"Internal state debt will rise from 753.8 billion crowns to 765.9 billion, with the simultaneous rise of the external state debt from 151.4 billion to 224.2 billion," the budget documentation showed.

The Finance Ministry traditionally leaves itself flexibility in domestic or foreign debt issuance, following market conditions, so the budget documents are not necessarily fully adhered to.

The ministry is due to release its detailed 2008 financing strategy on December 1.

Ministry officials responsible for debt financing were either not available or declined to comment.

Foreign debt stood at 123.1 billion crowns in June, compared with the 151.4 billion mentioned in the budget documents, showing there was also room for a potential issue worth about 1 billion euros ($1.41 billion) by the end of this year.

The ministry has long been considering an at least 1 billion euro foreign issue already for this year.

Some analysts said it was unlikely that the government would tap foreign markets amid the global credit crunch, but some said that sovereign debt may still be marketed.

The budget document showed that overall net bond issuance was planned at 60 billion next year, with an additional 10.2 billion coming through a rise in outstanding loans.

This would cover the planned budget deficit of 70.8 billion crowns.

But the Finance Ministry will also have to roll over a large chunk of debt, mainly maturing 5-year bonds worth 41 billion and 3-year bonds worth 49 billion crowns.

This year, the ministry rolled over 43 billion crowns worth of maturing bonds.

The Czech government has had no resistance to domestic funding, given the low Czech interest rates.

But the cost of money has risen this year, outpacing the yield pick-up in the euro area.

The 10-year swap rate stood at 4.44 percent on Monday, 25 basis points below the corresponding euro swap.

At end-2006, Czech 10-year swaps stood at 3.68 percent, 51 basis points below the euro equivalents. ($1=19.52 Czech Crown) ($1=.7087 Euro)

Keywords: CZECH DEBT/

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

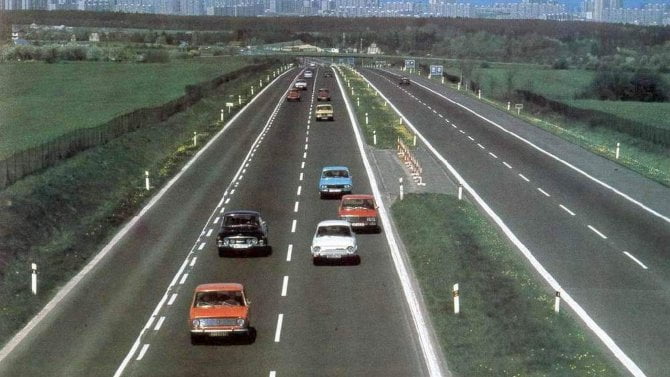

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze