...

The Czech crown hit record highs against the euro and the zloty was at 5-1/2 year highs on Friday, supported by strong local factors, but global liquidity concerns hit Bulgarian markets.

Several eastern European currencies pushed higher alongside the euro, which hit record peaks against the dollar on the growing view that a weak U.S. economic outlook will force another cut in U.S. interest rates.

The Czech crown , which hit a record versus the euro for a second straight day, has also traditionally benefited when nervous investors unwind carry trades, which involve borrowing low-yielding currencies like the yen and Czech crown to buy higher-yielding assets.

"We have already seen a lot of unwinding of carry trades in the Czech crown, and there are expectations the central bank will need to hike rates," said Simon Quijano-Evans, economist at Unicredit in Vienna.

A minority of analysts expect the Czech central bank to raise rates from the current 3.25 percent next week.

The Polish zloty hit 5-1/2 year highs against the euro for a third straight day on growing hopes of a market-friendly outcome to Poland's weekend election.

Opinion polls show the main opposition party, the centre-right Civic Platform, is leading the ruling conservatives.

While the election will almost certainly be followed by the formation of another coalition government, Civic Platform is perceived as more market-friendly than the current government.

BULGARIA WOES

Meanwhile, Bulgaria's credit default swaps spreads have widened and money market rates have been increasing, reflecting nervousness about the Balkan country's imbalances.

"The 5-year CDS widened 3 basis points this week, to 31 from 28 basis points, and volumes have been quite huge," one London dealer said. "People are shorting this credit, there are fundamentals that clients don't like."

The International Monetary Fund has voiced concerns that the new European Union member is showing signs of overheating with its growing current account deficit and accelerating inflation.

There are similar concerns about Baltic markets.

In Latvia, three-month money market rates were trading close to recent multi-year highs as the foreign minister quit and one cabinet member was sacked in a growing political crisis.

Worries about a possible Turkish incursion into northern Iraq continued to haunt Turkish assets following Wednesday's parliamentary vote in Ankara allowing troops to cross the border to hunt down Kurdish rebels.

Turkish stocks edged up after falling nearly 3 percent in the previous session and the lira was down half a percent against the dollar .

Turkey is serious about sending troops into Iraq and is not bluffing, a senior minister was quoted as saying on Friday.

Indian stocks dropped 4 percent on worries that foreigners might pull out, after the country's finance minister said a recent surge of funds into the country required some measures to ward off a stock market bubble.

The losses from recent stock market peaks in one of the world's fastest-growing economies fed into broader equity falls.

The MSCI benchmark emerging equity index dropped 0.33 percent, while the MSCI Asia ex-Japan index fell nearly 1 percent.

Pakistani shares fell briefly following an attack by a suspected suicide bomber that killed at least 133 people at a parade to welcome former prime minister Benazir Bhutto home. Shares hit a record high on Thursday.

Emerging sovereign debt spreads edged out by one basis point to 195 bps over U.S. Treasuries on the EMBI+ index .

(Additional reporting by Anna Mudeva in Sofia)

[LONDON/Reuters/Finance.cz]

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

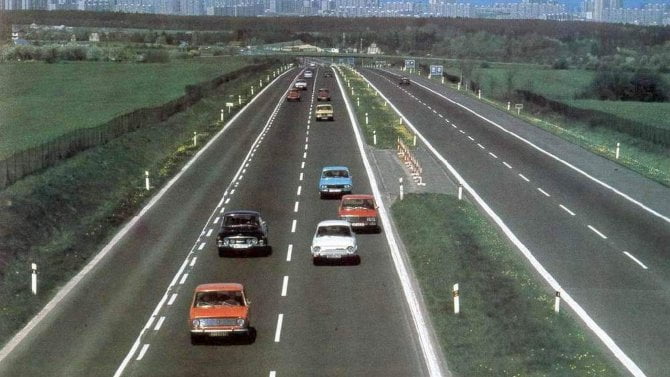

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme