The U.S. dollar remained under pressure against the euro yesterday, with investors taking profits ahead of Friday's closely-watched U.S. employment report for April. Higher-than-expected U.S. service sector activity gave the dollar only...

...short-term boost. The Institue for Supply Management's non-manuacturing index jumped to 68.4 in April from 65.8 in March. A consensus forecast had been for a drop to 64.0. A comparable indicator out of the euro zone showed the service sector index edged up to 54.5 in April from 54.4 in March. Today, traders will take a look at ECB's monetary policy meeting, where interest rates are expected to be kept unchanged. In the U.S., jobless claims are expected to come in at 335,000 for the latest week, little changed from previous 338,000 reading, while first-quarter productivity is forecast to have risen by 3.5%.

The Czech crown extended its gains to hit a three-week peak against the euro on Wednesday, helped by bullish sentiment at some other CEE markets. CNB Governor Tuma reiterated that the interest rate hike could come later this year, but the timing was unclear.

|

FX RATES |

| USD/CZK |

26.460/490 |

| USD/GBP |

1.7928/31 |

| EUR/CHF |

1.5497/7 |

| EUR/CZK |

32.170/185 |

| USD/YEN |

109.11/17 |

| EUR/GBP |

0.6782/84 |

| EUR/USD |

1.2157/61 |

| EUR/YEN |

132.68/77 |

|

STOCK MARKETS |

| NIKKEI |

11571.34 |

–190.45 |

| EUROSTOXX 50 |

2823.37 |

+23.66 |

| FTSE 100 |

4569.5 |

+22.3 |

| DAX 30 |

4022.10 |

+31.35 |

| DJ INDEX |

10310.95 |

–6.25 |

| NASDAQ |

1957.26 |

+6.78 |

| PX 50 |

794.4 |

–5.2 |

| GOLD |

392.90/+393.40 |

- |

| DEPOSIT RATES |

| |

CZK |

USD |

EUR |

YEN |

| ON |

1.90-2.00 |

0.99-1.04 |

2.04-2.07 |

--- |

| 3M |

2.01-2.11 |

1.12-1.17 |

2.04-2.07 |

-0.07---- |

| 6M |

2.15-2.25 |

1.33-1.38 |

2.06-2.09 |

-0.04-0.03 |

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Test Renault Rafale Atelier Alpine E-Tech 4×4 300: francouzský jednorožec

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Pneumatiky Baťa: Stopy českého průmyslníka se otiskly do všech silnic předválečného Československa

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Mnozí jste na ní jezdili jako děti, po více než 40 letech přichází konec. Dnes Tatra vyrobí úplně poslední kus modelu 815

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

Test Ford Capri: O Fordu Enyaq Coupé a vládci bez šatů

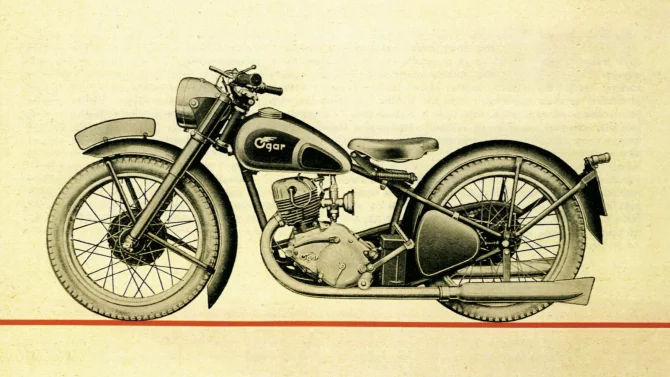

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce

Hadimrška, Aero Minor nebo Ogar 250. Co všechno se v Československu dalo koupit po válce