...ratings agency Fitch said on Wednesday.

Fitch said in its global sovereign ratings review that an increasing share of the European export market, economic reforms and expanding financial services sectors were all helping the former Soviet bloc nations grow much faster than western Europe.

It predicted the region as a whole would expand 5.4 percent next year, down from 6.2 percent growth expected in 2006, but way ahead of the euro zone and second only to emerging Asian economies.

While growth looked set to remain robust, booming credit, rising private sector foreign debt and high current account deficits could leave economies in the region exposed to a sharp global slowdown and a tightening in liquidity, Fitch said.

"The region has the largest gross external financing needs of any emerging market region, at $192 billion this year and $191 billion in 2007," it said.

"The emerging market sell-off in the spring supports the view that countries with large fiscal and external financing requirements, such as Hungary and Turkey, would be most in the firing line."

Fitch estimated that bank credit to the private sector was growing by just less than a third in 2005 and 2006, faster than in Asian countries before they were hit by the financial crisis of the late 1990s. It also said foreign currency bank lending dominated in the region, another risk factor.

The ratings agency said, however, that credit had been growing from a very low base. The dominant position of foreign banks in most countries also meant, in most cases, higher standards of risk controls.

It said flexible exchange rate regimes and prospects of euro zone membership were also making the region's economies more resilient than Asian economies in the 1990s.

"The credit boom is unsustainable in that it must at some point slow down. It need not necessarily end in tears," it said.

[WARSAW/Reuters/Finance.cz]

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

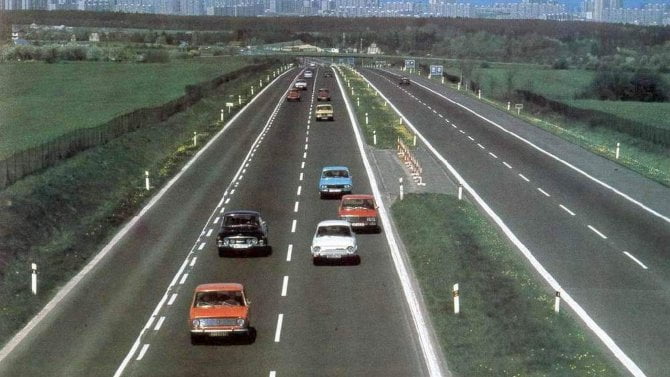

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze