PRAGUE, Oct 10 (Reuters) - The Czech Finance Ministry prefers to raise medium- and long-term domestic bond issuance over short-term bill refinancing if it opts out of further foreign borrowing this year, a ministry source said on Tuesday.

The official, who asked not to be identified by name, told Reuters the ministry might consider adding one or two medium- or long-dated bond auctions to the fourth quarter calendar if it decided to increase local currency borrowing.

But the source added no firm decision had been taken yet on what steps to take to cover a projected 18.8 billion crown ($840 million) hike in the government's funding requirements to meet unplanned payments before the year-end.

Investors have been uneasy about the domestic market's ability to absorb the rising supply of government bonds, fed by a burgeoning fiscal gap of the European Union member country. ((Reporting by Marek Petrus; Editing by Stephen Nisbet; Reuters Messaging: rm://marek.petrus.reuters.com@reuters.net; e-mail: prague.newsroom@reuters.com or marek.petrus@reuters.com; Tel: +420 224 190 477)) ($1=22.38 Czech Crown)

Keywords: MARKETS CZECH BONDS

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

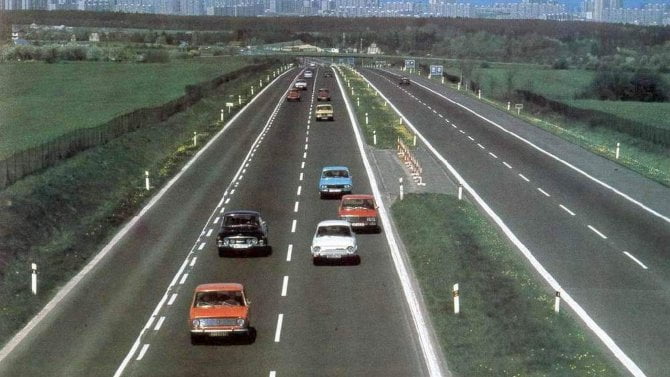

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme