(Adds CEO on share buyback, background, updates stock price)

By Patryk Wasilewski

WARSAW, Oct 25 (Reuters) - Czech power group CEZ <CEZPsp.PR> <CEZP.WA> gained nearly five percent on its Warsaw bourse debut on Wednesday which made it the biggest stock on central Europe's leading exchange and the bourse's first listed major utility.

Shares in majority state-owned CEZ opened at 120 zlotys ($38.85) in Warsaw, 3 percent above the reference price -- or Tuesday's stock close in Prague -- of 116.4 zlotys. It had gained ground to 121.9 zlotys at 1150 GMT.

In Prague, it hit a lifetime high of 883 crowns ($38.62).

Analysts said the group's debut was attractive for local cash-rich pension funds and predicted it would be a must-have stock for institutional investors as it looked set to enter Warsaw's blue-chip index WIG 20 <.WIG20>.

"It was a good debut," said Wlodzimierz Giller, analyst at Deutsche Bank Securities in Warsaw. "Some funds may have been waiting for the stock to start trading in Warsaw, though I think the biggest regional players have already bought CEZ in Prague."

The Warsaw bourse, whose capitalisation of domestic firms tops $130 billion, has been dominated by local banks, with the power sector represented only by a handful of small players such as Bedzin <BEDZ.WA> and Kogeneracja <KGEN.WA>.

Eight other foreign firms, including Bank Austria <BACA.WA> and Hungary's oil group MOL <MOLB.WA> have listed in Warsaw, hoping their stocks would benefit from strong demand from Polish pension and mutual funds which have limits on investing abroad.

CEZ stock has gained 40 percent over the past 12 months, beating the Prague PX index <.PX>, mainly due to rising electricity prices, foreign acquisitions and a dominant domestic position in both power production and distribution.

The Czech cabinet earlier said it might cut its 68 percent stake in CEZ by about 7 percent through a stock market offering in the first half of 2007 to raise budget revenues. But the fate of this plan is unclear, given opposition protests and the fact that the government lost a confidence vote in early October.

Chief Executive Martin Roman reiterated CEZ would consider buying back 10 percent of its shares to offset a state sale.

"The government first needs to decide on the way to sell its shares. If they decide to sell we will seriously consider (a share buyback)," Roman told reporters, adding the firm cannot buy the stake directly from the state due to legal constraints.

CEZ, central Europe's largest utility group, has been on an acquisition trail throughout the region, buying power generation plants and distribution assets in Poland, Bulgaria and Romania.

It is in talks to buy distribution assets in Ukraine and is bidding to build power stations in Bulgaria, Bosnia and Kosovo.

Roman said CEZ also plans to finalise a deal to build a gas-fired power plant near Moscow in the coming months.

In a prospectus for the share listing in Warsaw, CEZ said it was ready to use all 6 billion to 7 billion euros in cashflow it generates by 2009 for acquisitions.

CEZ has two nuclear power stations, Temelin and Dukovany, in the Czech Republic, a range of coal-fired and hydroelectric power stations, and most of the Czech distribution network. ((Writing by Ewa Krukowska and Pawel Kozlowski, editing by Quentin Bryar; Reuters Messaging: ewa.krukowska.reuters.com@reuters.net; tel. +48 22 6539710))

($1=3.089 Zloty) ($1=22.61 Czech Crown)

Keywords: UTILITIES POLAND CEZ

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

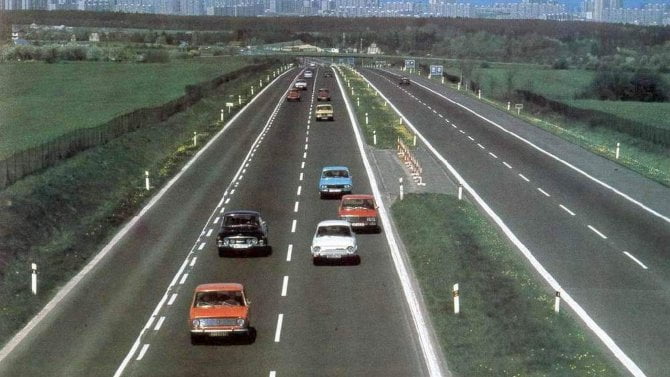

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují