LONDON, Sept 25 (Reuters) - Czech power utility CEZ <CEZPsp.PR> plans to sell a benchmark-sized euro bond after European investor roadshows next week, the banks managing the sale said on Monday.

Deutsche Bank and SG CIB are joint bookrunners for the deal, which will follow investor meetings in Vienna, Frankfurt, London and Paris that run from Oct. 3 to Oct. 5.

Benchmark euro bonds usually total at least 500 million euros ($639 million).

CEZ holds an A2 credit rating from Moody's Investors Service and a BBB+ rating from Standard & Poor's. ((Reporting by Quentin Webb; editing by Paul Bolding; Reuters Messaging: quentin.webb.reuters.com@reuters.net; +44 207 542 9405)) ($1=.7828 Euro)

Keywords: ENERGY CEZ BOND

Na český trh vstoupil další elektromobil, který má ambice nahradit Golf nebo Octavii. EV4 ujede přes 600 km a stojí pod milion

Na český trh vstoupil další elektromobil, který má ambice nahradit Golf nebo Octavii. EV4 ujede přes 600 km a stojí pod milion

V Evropě se objevil návrh na to, jak od elektromobilistů vybrat peníze, když neplatí daně z paliva. Zdanit se má soukromé nabíjení i ujeté kilometry

V Evropě se objevil návrh na to, jak od elektromobilistů vybrat peníze, když neplatí daně z paliva. Zdanit se má soukromé nabíjení i ujeté kilometry

Test Citroen C3 Aircross: Na velikosti záleží

Test Citroen C3 Aircross: Na velikosti záleží

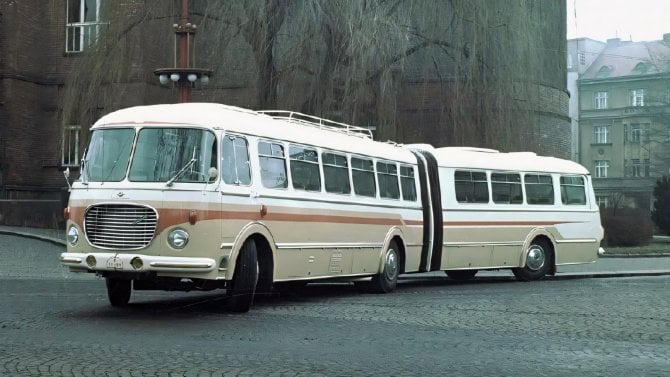

Po stopách prototypů československých užitkových vozidel. Dochovalo se jich jen minimum

Po stopách prototypů československých užitkových vozidel. Dochovalo se jich jen minimum

Nastavoval intenzitu elektronické cigarety za volantem, dostal pokutu. Podle soudu je e-cigareta mobil

Nastavoval intenzitu elektronické cigarety za volantem, dostal pokutu. Podle soudu je e-cigareta mobil