Oct 16 (Reuters) - The Slovak 2007 state budget draft was

sent to committee this week ahead of the first of three

parliamentary readings required for it to pass.

The government-approved draft sets the ceiling for the key

public finance deficit at 2.9 percent of estimated GDP.

The first reading is expected on Dec. 5.

The following is a summary of the fiscal plan for 2007.

CENTRAL STATE BUDGET:

2006 2007 2008 2009

(SKK bln)

(local cash-flow methodology)

Revenues 272.7 308.1 326.3 352.4

Expenditure 330.2 347.0 349.7 366.1

Balance -57.5 -38.9 -23.4 -13.7

Balance (ESA 95) -69.0 -32.2 -48.6 43.9

PUBLIC SECTOR BUDGET 2006 2007 2008 2009

(SKK bln)

(ESA 95)

Revenues 564.0 601.7 630.9 672.8

Expenditure 608.4 654.3 677.6 712.4

Balance -44.4 -52.6 -46.7 -39.6

Balance (pct of GDP) -2.9 -2.9 -2.4 -1.9

- Revenue and expenditure data for the central state budget

are calculated according to local cash-flow methodology.

- The key figure for Slovakia's target to adopt the euro in

2009 is the overall public finance deficit calculated according

to the European Union's ESA 95 methodology.

- The cash-flow methodology takes in revenues and expenditures

when money arrives or leaves state accounts, while the accrual

ESA 95 method includes revenues and expenditures as they occur.

- The central budget is the major part of public finances. The

overall public finance deficit ceiling for 2006, including the

cost of pension system reform, was set at 4.2 percent of GDP.

- The calculated cost of the pension reform is 1.1 percent of

GDP in 2007.

- Slovakia joined the Exchange Rate Mechanism 2 (ERM-2), a

waiting room ahead of euro adoption, in November 2005, with

the crown's central parity rate set at 38.4550 to the euro.

TIMETABLE

- Deputies are now starting to discuss the budget draft in

various parliamentary committees.

- Parliament will debate the draft for this first time at a

regular session starting on Dec. 5

- Parliament has no deadline for approving the 2007 state

budget. The state would start next year with a provisional

budget if deputies fail to pass the regular budget law by the

end of 2006. But with a solid majority in parliament, the

government is expected to approve the draft easily.

TAX CHANGES

INCOME AND CORPORATE TAX

- Income and corporate tax rates remain at 19 percent.

- Tax relief measures for those earning more than 46,700 crowns

in 2007 are reduced.

- A loophole allowing companies to grant 2 percent of their

taxes to non-government organisations is reduced to 0.5 percent.

- The fiscal benefit should total 1.7 billion crowns in 2008,

rising to 1.9 billion in 2009. An estimate of the impact

in 2007 should be released in the coming days.

VALUE-ADDED TAX

- The value-added tax (VAT) rate for drugs and some other

medical goods is cut to 10 percent from 19 percent.

- The finance ministry estimates the proposed change will

reduce state budget income by some 2.7 billion crowns next year,

or 0.18 percent of GDP. That reduction edges up to 2.8 billion

crowns in 2008 and 3.0 billion crowns in 2009.

(Reporting by Martin Santa in Bratislava)

((Editing by Gerrard Raven; martin.santa@reuters.com; Reuters

Messaging: martin.santa.reuters.com@reuters.net; +421-2 5341

8402))

Keywords: ECONOMY SLOVAKIA BUDGET

Nákup ojetiny jako rizikový podnik. Každá druhá ojetina ihned potřebuje nečekanou opravu za mnoho tisíc

Nákup ojetiny jako rizikový podnik. Každá druhá ojetina ihned potřebuje nečekanou opravu za mnoho tisíc

Na český trh vstoupil další elektromobil, který má ambice nahradit Golf nebo Octavii. EV4 ujede přes 600 km a stojí pod milion

Na český trh vstoupil další elektromobil, který má ambice nahradit Golf nebo Octavii. EV4 ujede přes 600 km a stojí pod milion

V Evropě se objevil návrh na to, jak od elektromobilistů vybrat peníze, když neplatí daně z paliva. Zdanit se má soukromé nabíjení i ujeté kilometry

V Evropě se objevil návrh na to, jak od elektromobilistů vybrat peníze, když neplatí daně z paliva. Zdanit se má soukromé nabíjení i ujeté kilometry

Test Citroen C3 Aircross: Na velikosti záleží

Test Citroen C3 Aircross: Na velikosti záleží

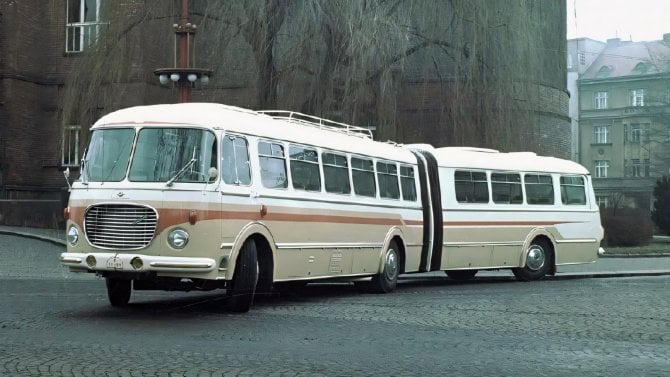

Po stopách prototypů československých užitkových vozidel. Dochovalo se jich jen minimum

Po stopách prototypů československých užitkových vozidel. Dochovalo se jich jen minimum