...improving inflation outlook.

Producer prices fell 0.8 percent month-on-month in December, putting annual factory-gate inflation at 5.4 percent, the Statistics Office said.

Analysts had forecast a 0.1 percent monthly rise in producer prices, and an annual inflation rate of 6.3 percent.

"With base effects expected to push January CPI lower, it may fuel expectations for an interest rate cut," said 4cast analyst Piotr Matys.

Industrial product prices fell by 0.3 percent on the month, the cost of raw materials was down 3.2 percent and energy prices fell by 1.2 percent.

Rising oil costs in 2006 helped feed a jump in consumer prices that pushed the central bank to raise interest rates to avoid demand-led inflation pressures endangering Slovakia's goal of adopting the euro in 2009.

However, analysts said producer prices have limited impact on consumer price inflation and so should not be a major consideration for the central bank when it next reviews policy on Jan. 30.

"We see only limited implications for the next week's rate decision from the reading, although it undisputedly confirms the improving inflation outlook," said ING bank senior analyst Lucia Steklacova, expecting rates to stay on hold on Tuesday.

Slovak annual EU-norm inflation, the central bank's key price yardstick, held steady at 3.7 percent in December, and the rate is expected to decline towards 2.0 percent this year.

The central bank raised the key two-week repo rate by 175 basis points in four steps to 4.75 percent last year, but a firming crown in the past four months has tightened monetary conditions and helped improve the inflation outlook.

A central bank board member, Ludovit Odor, said on Thursday the bank may have finished its rate hiking cycle, and the debate would now be whether it can cut rates.

[BRATISLAVA/Reuters/Finance.cz]

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

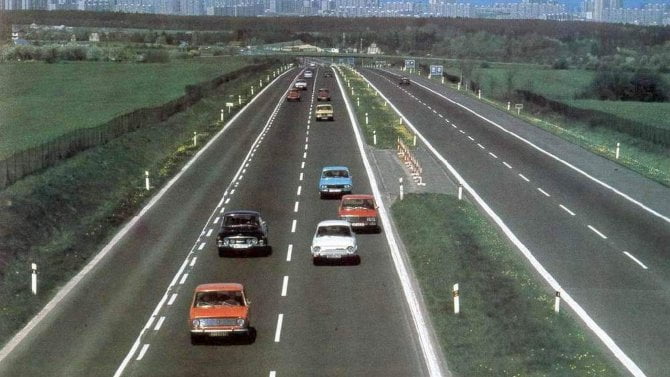

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují