By Martin Santa

Higher than expected Slovak

consumer price data on Friday could blur the timing of an

expected interest rate cut, but does not jeopardise the

country's drive toward euro entry, analysts said.

Slovak consumer prices rose by 1.0 percent month-on-month in

January, putting the annual inflation rate at 3.0 percent. While

the headline figure was down from 4.2 percent in December, it

exceeded the median forecast of 2.6 percent in a Reuters poll.

"The actual outcome exceeded our forecast of 2.5 percent

year-on-year and is clearly a negative surprise for the market.

However, there is no need for panic," said analysts at

Raiffeisen Zentralbank.

Slovakia is looking to adopt the euro in 2009, and is

struggling to keep consumer price growth in line with the

Maastricht criteria for entrance to the euro zone.

Analysts said Friday's data, calculated under local

methodology, were disappointing but due mainly to the influence

of regulated prices -- which is higher than in EU-norm

calculations.

The central bank, which targets EU-norm inflation, predicts

that rate will fall to 1.5 percent at the end of 2007. The

euro-entry inflation ceiling in December was 2.9 percent.

The central bank hiked the key two-week repo rate by a total

of 175 basis points with a series of increases in the past year.

But a strong crown -- which showed no reaction to the data

-- has helped keep a lid on inflation despite a booming economy

and growing wages.

The NBS left rates unchanged in January for the fourth month

in a row but an easing of policy is still expected, though

possibly not until the second half of the year, analysts said.

"The outlook for meeting the Maastricht criteria is good,"

said Slovenska Sporitelna analyst Maria Valachyova.

"However, there are still risks which should prevent the

central bank from any hasty interest rate cuts."

In a separate data release, the foreign trade balance showed

a deficit of 12.48 billion crowns ($468.3 million) in December,

above the market prediction of a 10 billion crown gap. But

analysts said the outlook remains bright due to a burgeoning

auto industry which is gearing up production to be exported.

"We expect accelerating exports from January, and a

reduction of the deficit by half this year." said Lucia

Steklacova, senior analyst at ING Bank Bratislava.

[BRATISLAVA/Reuters/Finance.cz]

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

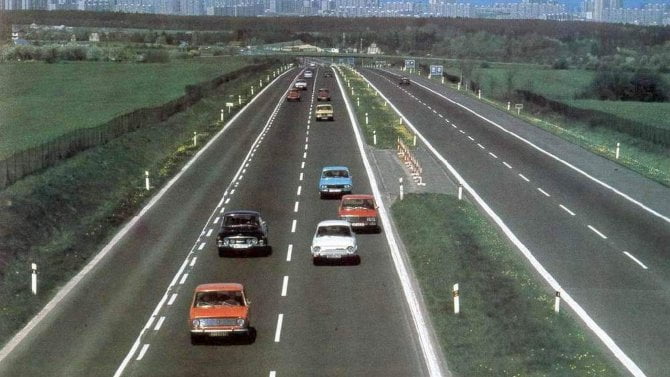

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test ojetiny: Levná vstupenka do Jaguaru klubu. XF II koupíte za super peníze

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Test Mitsubishi ASX 1.3 DI-T Instyle (2025): Levná normální auta pořád existují

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme

Československá hrdinka volantu: světově proslulé Elišce Junkové by bylo 125 let. Nezapomněli jsme